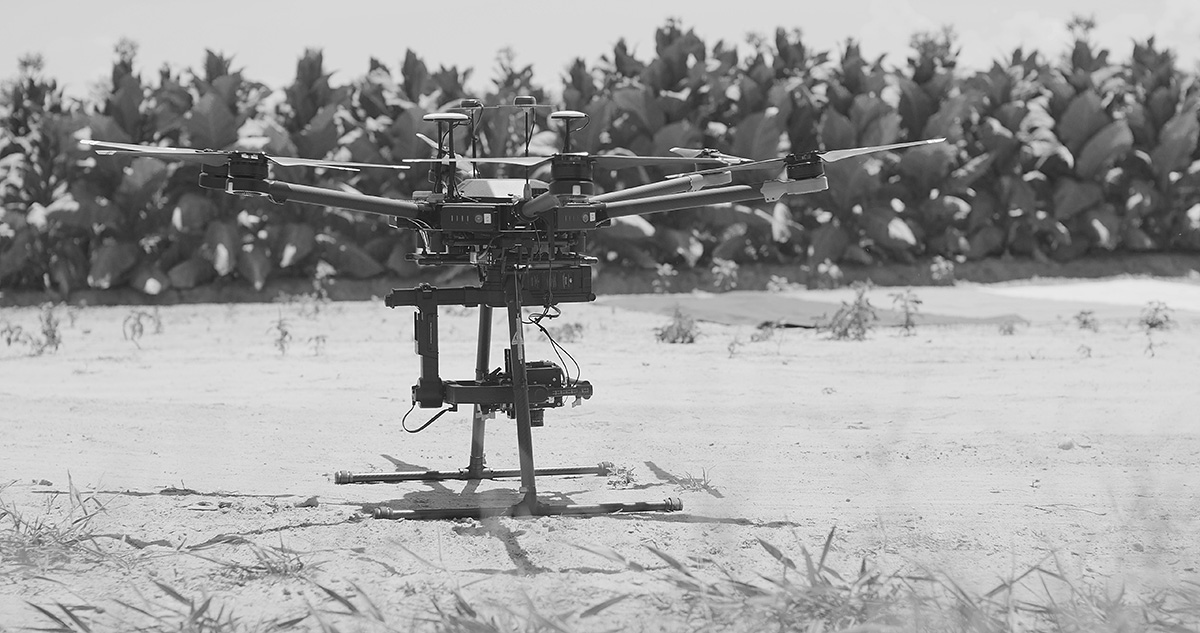

In recent years, savvy farmers have begun to use drones to better manage their crops and livestock. With their bird’s eye view and advanced sensors, a drone can gather data on 500 to 1,000 acres in less than a day, making it so farmers can measure plant health, forecast yield, and gather other data critical the management of their farm.

Now, the companies that insure those farms have begun to realize benefits, too. Crop insurers are employing drone-based aerial intelligence to increase efficiency, reduce human error, and better guide decisions when processing claims.

The crop insurance claims cycle: slow and erroneous

For many of today’s farmers managing acres upon acres of land, filing a claim requires that their insurer conduct a time-intensive appraisal. This process involves someone physically coming and surveying the land, gathering as much visual data as they can, and building a claim from those notes. For many claims adjustors, this meant standing on the back of a tailgate of a truck and looking over a field, taking pictures of structures, and collecting those pictures to make an assessment of the property.

This process is costly, time-consuming, and often doesn’t yield the data-rich, meaningful information that farmers or insurance companies need. In the best case, a claims agent captures ground-based digital imagery. However, this imagery lacks geospatial precision and repeatability. In the worst case, estimates are left to the adjuster’s visual judgement—a subjective and imprecise measure. Ultimately, this “boots on the ground” method for crafting claims results in reactive decisions based on information potentially tainted by human error.

As a result, insurers might overpay or underpay claims, drawing the ire of shareholders, customers, and/or regulators. Worse, bad claims data underlies other costly issues. Underwriters, for example, might struggle to make accurate forecasts; and fraud investigators can miss false claims.

How drone-based crop assessments work

Now, there’s a better way to manage crop insurance claims. By deploying drones, adjusters can:

- Accelerate inspection—Assess 200 acres in 20 minutes

- Structure assessments—Make precise assessments based on structured aerial data

- Foster transparency—Offer clients by showing them where damage, and how much, has occurred

- Empower greater profitability—Deliver consistent and accurate payouts to customers and provide intelligence to underwriters and fraud investigators

Here’s how it works:

- Deploy—Claims operators use a centralized fleet management system to deploy credentialed and insured drone pilots to the site of a claim, with or without adjusters

- Collect—Drone pilots collect aerial imagery, following a predefined flight plan, or one developed on-site

- Analyze—Drone pilots or adjusters use an offline or cloud-based tool to automatically process noticeable differences in crops, measuring measure acreage, damage severity, and other plant health attributes

- Action—Adjusters, in the field or remotely, use visual reports and damage measurements to determine a precise payout

Using drones to strengthen the claims data value chain

According to Kevin Lang, GM of Agriculture, PrecisionHawk is “bringing crop insurance companies to a new era,” by “enabling them with information that should be readily available.”

For farmers and claims adjusters needing to correctly assess the health of a crop, it isn’t just about the drone itself–it’s the quality and analytical benefit of the data it captures. PrecisionHawk’s solution meets this need by capturing images that are stitched together and analyzed by machine-vision algorithms. For example, with this technology, claims adjusters can not only identify how many crops were damaged, but the type and level of damage (i.e. green snap vs. lodged corn).

“How we’ve done that is we’ve gotten different groundtruth data and used that information to train our machine learning models,” said Kevin Lang, GM of Agriculture. PrecisionHawk then gathers analytics site-by-site, depositing the information into a digestible, comprehensive management tool where insurers can see their imagery and craft their claims using precise measures.

These benefits aren’t just for professionals creating claims. Farmers can harness the same data from to identify and correct areas of concern before planting season, during the growing season, and beyond. Not only do farmers get a precise payout, but they get data to helpe them maximize crop output, too.